How our ALM solution reduced report generation time by 40X for a large NBFC

About the client

Our client is a large NBFC with a total asset under management (AUM) of over ₹7,000 crore and a customer base of over 4.5 million people. The client has geographical presence in several major states of India including Gujarat, Rajasthan, Maharashtra, Madhya Pradesh, Delhi, Chandigarh etc. and 500+ branches The client offers a variety of financial products and services, including gold loans, home loans, and business loans.

Business challenge

Asset Liability Management (ALM) report is a crucial assessment that provides an overview of the business’s resilience and cash flow under various scenarios. ALM report generation is an important exercise conducted primarily by the risk team to estimate the robustness of the business.

Additionally, RBI has issued a set of guidelines on the management of liquidity and solvency by non-banking financial companies (NBFCs), which requires all NBFCs to file DNBS 4B returns covering periodic ALM reports.

Each time the ALM report needed to be filed, multiple departments across the company needed to collaborate to gather and organize data from 12 different record systems of lending and borrowing. It needed a team to then calculate the ALM return manually. This entire process used to take 15-20 days. The possibility to delay and inaccuracies meant not only potential penalties and customer trust issues, but also possible legal action.

Our client needed an automation solution that could quickly generate accurate ALM reports without manual intervention.

Our solution

We worked deeply with all the client departments involved in the reporting process to understand the nuances of their processes, data formats, and retrieval mechanisms.

Through our analysis, we identified the below gaps in the current process of generating ALM reports manually:

- Data collection: The data required for ALM reports was spread across multiple systems and departments

- Data classification: Data classification was being done manually which meant that assumptions had to be keyed in each time to generate a report.

- Report generation: The process of generating ALM reports can be complex and time-consuming. This can lead to errors and delays in report generation

Because customer trust and regulatory compliance was at stake, we knew that the solution had to be risk free and fully compliant with RBI guidelines.

Using multi-source integrations, we developed a central data repository and enabled one-click automation to generate a robust ALM report that captures the below business critical insights.

- Structural liquidity – Our system calculates the structural liquidity by mapping inflows and outflows of cash across time periods and by grouping them into buckets based on their maturity. The gaps between inflows and outflows in each bucket are then calculated. The RBI has defined ranges for these gaps, and NBFCs are required to keep their gaps within these ranges. Our model also utilizes historical data to predict loan prepayments, providing valuable insights into future prepayment behavior. We have incorporated a customized model specifically designed to forecast prepayment profiles. As a result, we are able to offer enhanced visibility into behavioral liquidity, giving the client a clearer understanding of their loan prepayment patterns.

- Interest rate sensitivity – Our system calculates this by considering only those cash flows that will change as interest rates change. The sensitivity of each cash flow is then calculated, and the results are aggregated to get an overall measure of interest rate sensitivity.

- Dynamic liquidity – Our system maps assumptions around future financial decisions of the client and helps them give an insight into their dynamic liquidity. This is done by understanding their budgets & pipelines to plot increase/decrease in portfolio and corresponding change in liquidity.

Our five part automation system for the client includes:

- A data repository integration including LMS systems, treasury systems, accounting system and additional Excel inputs to ensure data collection does not become a bottleneck given a number of departments involved

- A validation engine to ensure correctness of the data

- A configuration layer that maps data as per different behavioral assumptions

- A reporting engine that captures users assumptions in line with RBI guidelines and generates the report as per regulatory requirements

- A user interface to allow users to run reports and view data

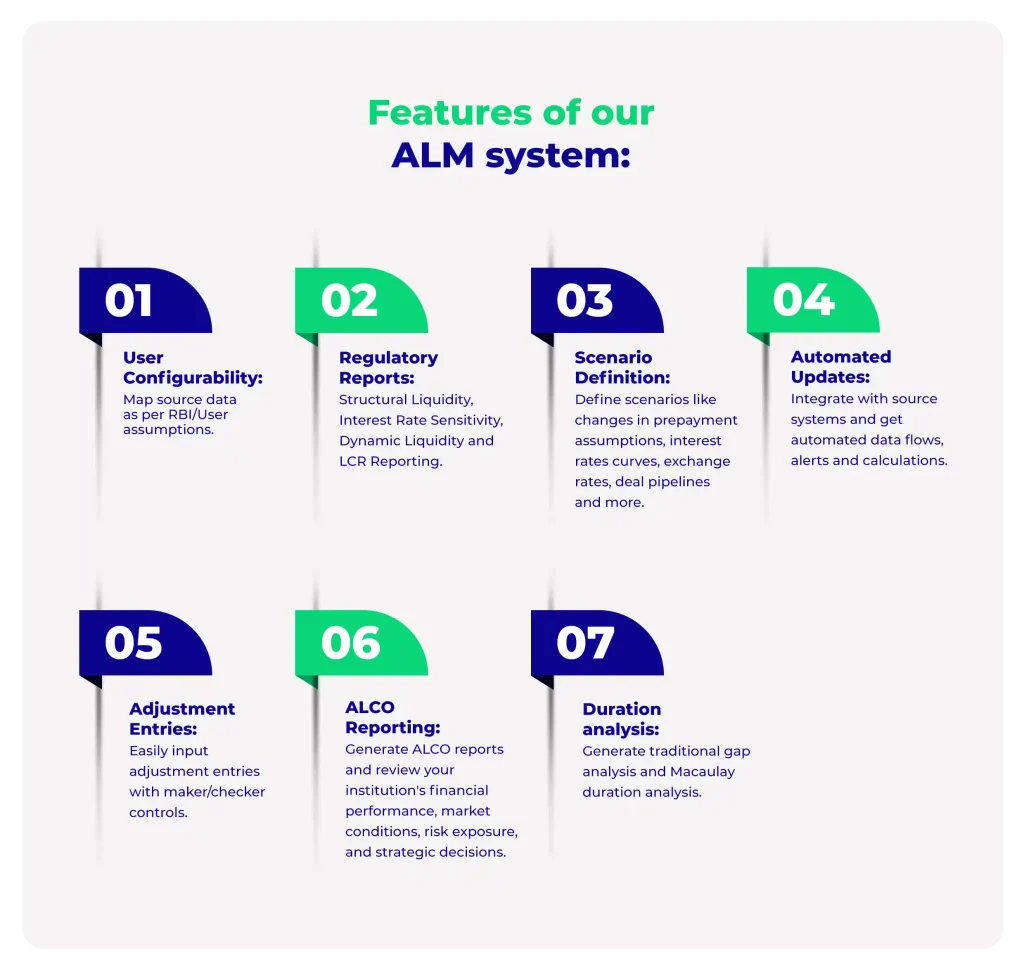

Features of our ALM system

1) User Configurability: Users can configure their own rules for mapping source data to financial heads and buckets as per RBI/User assumptions.

2) Regulatory Reports: The report is generated in RBI prescribed format which helps while filing a return at the RBI portal. Additionally, the system provides working files which helps in identifying values shown in the report.

Following Reports are generated by the system:

- Structural Liquidity

- Interest Rate Sensitivity

- Dynamic Liquidity

- LCR Reporting

3) Scenario Definition: Users can define various scenarios to simulate expected behavior of their organization’s assets and liabilities in various market conditions. These scenarios could include changes in prepayment assumptions, interest rates curves, exchange rates, deal pipelines, or any other relevant market factors.

4) Automated Updates: System integrates with source systems and provides automated data flows, alerts and calculations.

5) Adjustment Entries: System provides a user-friendly interface that allows users to easily input adjustment entries with maker/checker controls.

6) ALCO Reporting: The system also supports users by generating various ALCO reports which helps them review and discuss the institution’s financial performance, market conditions, risk exposure, and strategic decisions.

7) Duration analysis: System also generates traditional gap analysis and Macaulay duration analysis.

Outcomes

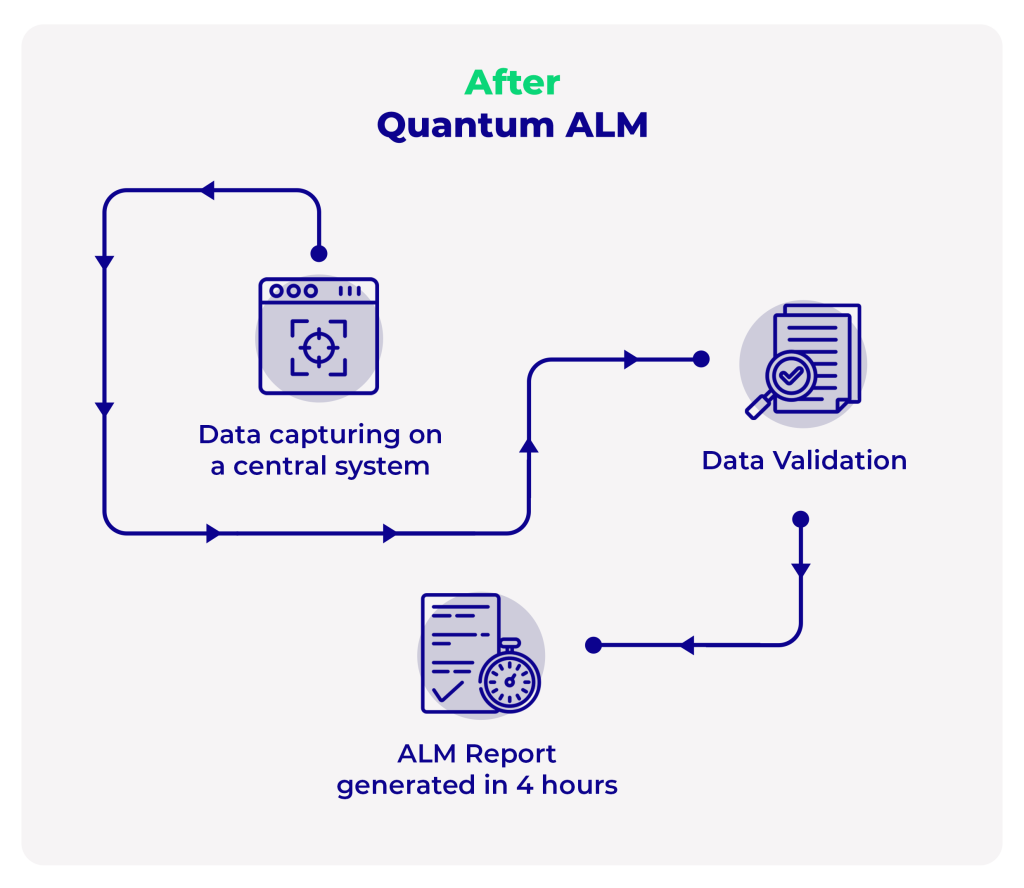

We automated the entire ALM report generation process, from data collection to report generation. This eliminates the challenges faced when generating ALM reports manually and ensures that reports are accurate and timely.

Here are some of the benefits of using our system to generate ALM reports:

- Improved accuracy: Our system eliminates the possibility of human errors in data collection, cleansing, and report generation. This ensures that ALM reports are accurate and reliable. Instead of people needing to send files across departments, all 12 files can now be uploaded in a single system.

- Improved timeliness: We integrated our automation into the client’s core system and the report can now be generated at the click of a button. As a result, the ALM output generation time was reduced from 15-20 days to 4 hours only

- Regulatory compliance: With enhanced speed of ALM calculations and report generation, our client could also ensure that they were 100% compliant and risk-free with respect to regulatory requirements.

What stood out the most for our client was that we were able to complete end-to-end system implementation in a record time of 60 days.