Why is the BSDA list scrutiny critical?

As per SEBI Circular CIR/MRD/DP/22/2012, all depository participants (DPs) are required to make available a “Basic Services Demat Account” (BSDA) for the benefit of retail investors. For this purpose, every brokerage firm gathers the entire data, of around 3 Million people, to scrutinize from various sources. The endgame is to identify clients that are eligible for a free DP account on the basis of multiple guidelines set by SEBI (mentioned below). The entire process is extremely critical as the firm’s revenue depends on it as well as the NSDL reporting.

SEBI Guidelines

- All eligible individuals to have only one demat account where they are the sole or first holder

- An individual can have only one BSDA in his/her name across all DP

- Value of securities shall not exceed Rupees Two Lakhs at any point of time

- No (AMC) if the value of holding is up to Rs. 50,000

- AMC not more than Rs 100 for value of holding from Rs 50,001 to Rs 200,000

- People who have any other demat account where they aren’t the first holder, are also eligible for BSDA

What is the current process?

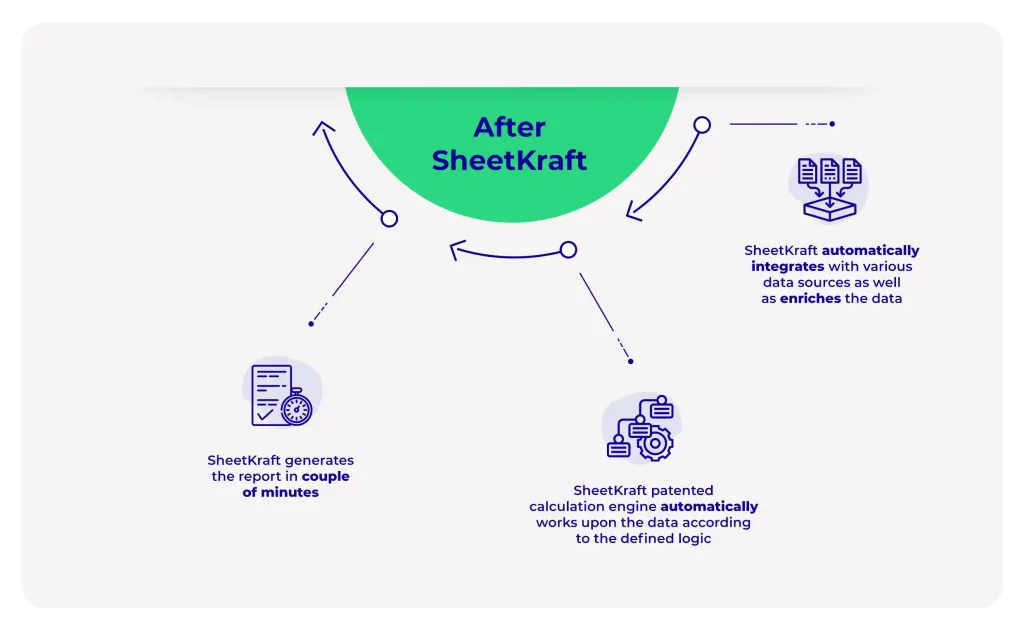

Automating with SheetKraft

SheetKraft is our proprietary rapid application development framework that has been deployed at multiple financial organizations (including Brokerage firms) for Business Process Automation. Using SheetKraft, you can save hours of manual work and streamline your BSDA Reporting.

Impact you can drive with SheetKraft